Welcome fren! One of the most fundamental questions beginners ask (and get horrifically wrong) is what is a Bitcoin wallet? While it might seem simple to answer – “it’s your account on Coinbase!” 🤮 – there’s extremely important information you need to know before blindly buying your first bitcoin. It can easily save you from losing your entire stash one day and getting rekt. You’ve been warned!

Contents

What Is A Bitcoin Wallet?

A Bitcoin wallet is simply software that:

- Generates and manages your Private Keys, which gives you access to spend your bitcoins

- Generates and manages your Bitcoin Addresses, so you can receive bitcoins

- Creates and broadcasts transactions to the Bitcoin network so you can spend your bitcoins

They come in many shapes and sizes such as this software wallet called Sparrow Wallet.

The first and most important thing you need to know about all Bitcoin Wallets is that they do not store any bitcoins! The name “wallet” is used because the creators of the software are trying to make it easily relatable to everyday people, but in actual fact Bitcoin Wallet software isn’t like a normal “wallet” that might store physical cash or coins. It’s not even like a bank account.

Instead, Bitcoin Wallets only ever store your private keys which is what gives you access to your bitcoins. Every bitcoin is and always has been located on the Bitcoin network. In summary:

- Bitcoin Wallet: Stores your private keys

- Bitcoin Network: Stores your bitcoins

This might seem like a simple distinction, but it’s a critical one that is very important to understand and embed right from the start as otherwise it leads to lots of confusion.

People mistakenly believe that if they uninstall their Bitcoin Wallet software “all their bitcoins are now gone”. This isn’t true as long as you still have your private keys. Again, there are no bitcoins ever “stored” in your “wallet”, only private keys.

The easiest way to properly think about a Bitcoin Wallet is to instead think of it as a “viewer”. You use this viewer software to look into the Bitcoin network and view what bitcoins you own with your specific private keys.

Private Key vs Public Key vs Seed Phrases

So what the hell is a private key then anyway? A private key is a cryptographic key that gives you access to your bitcoins on the Bitcoin network and looks something like this:

185082410266061011419354707831708373725981652362318265124838197206310542791322

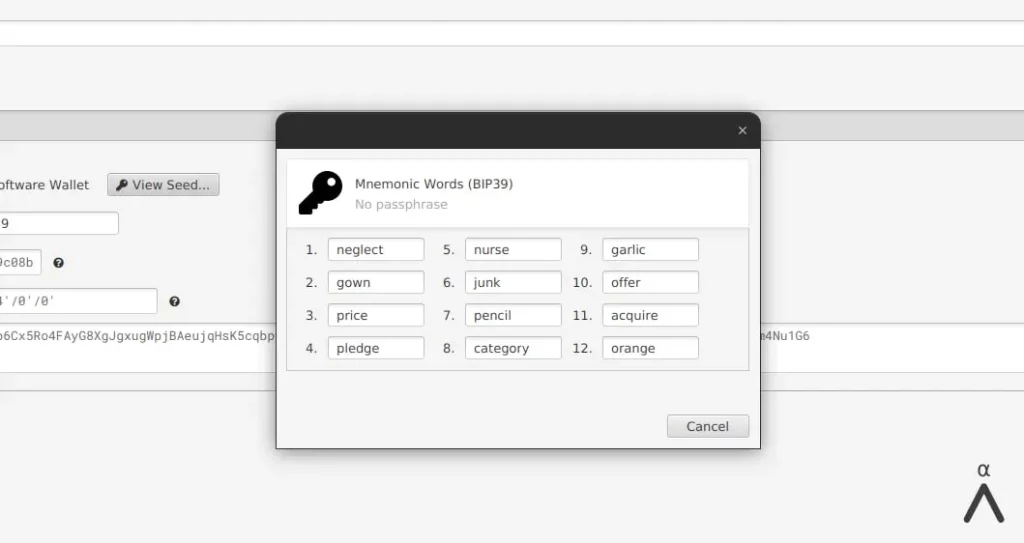

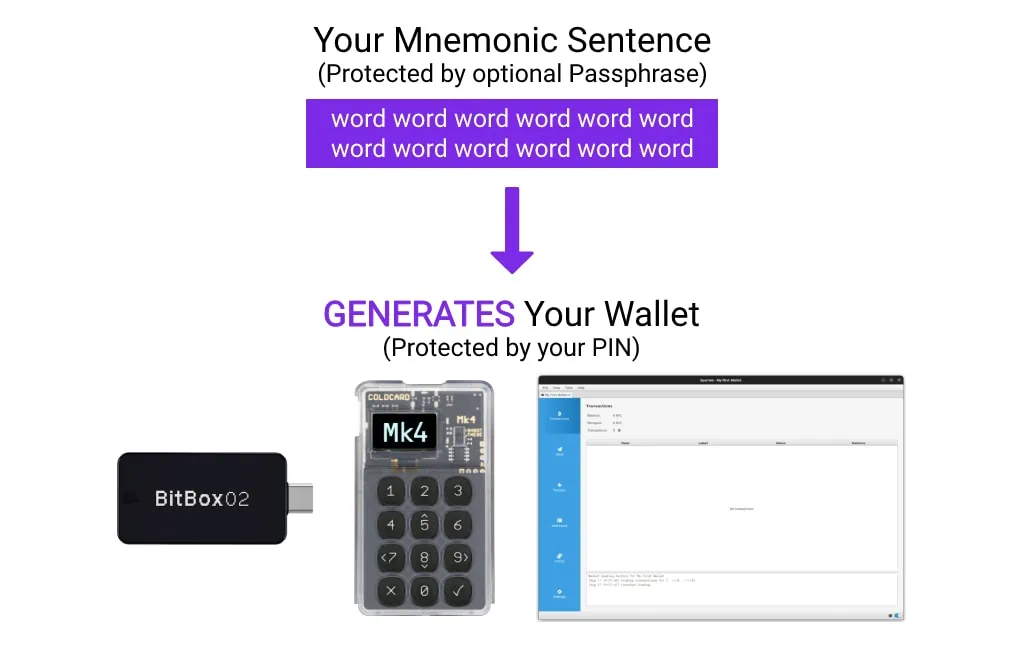

This huge random looking number is obviously impossible for normal people to remember so modern wallets instead use this to generate your Mnemonic Sentence.

This is either 12 or 24 words that most wallet software provides to you and asks you to store in a safe place. The Mnemonic Sentence is most commonly referred to as a Seed Phrase, but it also goes by the names Mnemonic Words, Seed Recovery Phrase or Backup Seed Phrase.

Some people mistakenly call it the “private keys” but as you can see, these are two completely different things!

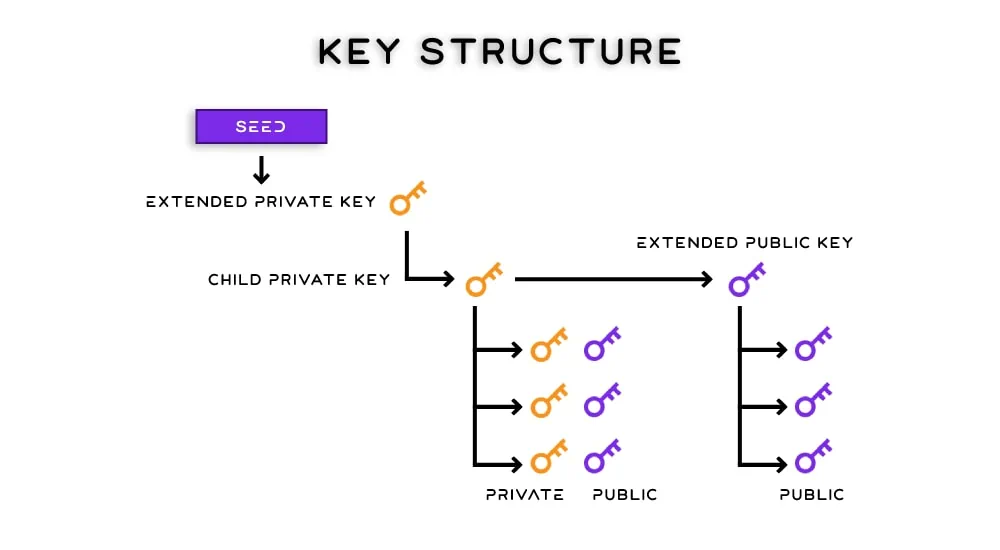

The wallet uses this private key to generate a corresponding public key which is what’s used by other people to send you bitcoins, similar to the address of a house. So in summary:

- People use your public key to know where to send you bitcoins

- You use your private key to spend those bitcoins

- Your Mnemonic Sentence is generated from your private key and is just 12/24 words

Public keys are free to be shared publicly, while private keys and your Mnemonic Sentence should always be kept private. If anyone else gets a hold of your private keys or Mnemonic Sentence, they can just install any Bitcoin Wallet software, enter either of them in and steal your bitcoins and no one can stop them.

There is a lot more to this system including how these private keys are generated, how the Mnemonic Sentence is generated, passphrases, how keys are used to sign transactions and more, but it is outside the scope of this piece. That’s why we have a totally separate piece that explains What Public And Private Keys Are.

Self-Custodial vs Custodial Wallets

As private keys give you access to your bitcoins, it’s important to know who holds them:

- Self-Custodial: You hold the private keys and have full control of your bitcoins

- Custodial: A third party (custodian) holds the private keys giving them full control of your bitcoins

While not specifically stated in the Bitcoin Whitepaper, the general ethos of Bitcoin is that you should always have custody of your bitcoins and hold your own private keys. You should be the only one that holds the private keys as otherwise you have to place your trust in other third parties.

While some people choose to willingly give their private keys to other businesses – typically centralized exchanges explained below – it’s not recommended, especially for medium to large amounts. When a wallet is “custodial” it means you only have access to your bitcoins if that third party allows you to.

>> Learn More: How To Send Bitcoin

If they think you have done something wrong, don’t like where you want to send your bitcoins, think you have violated their T&Cs, are forced by a government or simply just go bankrupt or get hacked you will lose access to your funds.

Virtually all of these third parties now also force you to prove your identity with highly invasive privacy checks, usually referred to as KYC or AML. Furthermore, it can mean it takes much longer to send your bitcoins if you have to wait for their approval.

This isn’t just theoretical either, people have repeatedly Lost Bitcoin that were stored with these third party companies through hacks, employees disappearing with customer funds (fraud), CEO’s dying and losing the access to the funds and lately, degenerate and greedy gambling of customer funds.

While there are a few legitimate use cases for using custodial wallets, there are many, many excellent self-custodial wallets available across all platforms that are just arguably better in most metrics. Don’t let anyone fool you into giving up your private keys. As the famous saying goes…

Not your keys, not your coins!

New to Athena Alpha? Start today!

Software vs Hardware Crypto Wallets

One of the biggest risks to keeping your bitcoins safu has always been hacking, scams or social engineering which software of all types is highly susceptible to. To help users combat this Hardware Crypto Wallets were created.

Hardware Crypto Wallets are dedicated pieces of physical hardware that generate, store and manage your private keys as well as sign transactions.

By separating your private key onto a physical hardware device, away from your disgustingly malware infested computer that’s running the software component, it drastically increases the security of your bitcoin storage setup. Some of our top recommendations include the BitBox02, Foundation Passport, COLDCARD Mk4, Blockstream Jade or SeedSigner.

Note: We do not recommend any Ledger devices as they do not meet our privacy or security standards. We know they’re a very popular option, especially for beginners, but they are not a good solution.

With your funds stored with a Hardware Wallet, a hacker can get full control of your computer or phone and all they can do is view your wallet. In order to steal (or spend) your bitcoins they would need your Hardware Crypto Wallet to be plugged in and unlocked. Then they’d also need to push physical buttons on it too somehow. This extra physical layer makes hacking attacks much harder to execute.

Hardware wallets cost anywhere from $60-$200 USD. This is also a one time cost that is highly recommended if you’re storing medium to large amounts of bitcoin.

🚨 Be very careful when purchasing any hardware crypto wallet! 🚨

You should only ever purchase it directly from the manufacturer, never second hand! It should ideally come in a tamper resistant bag, be open source and well respected and vetted by the community. You should also try as hard as possible to ensure the purchase name, address and funds are not linked in any way to your identity.

This is because if the hardware wallet company gets hacked, and the hackers get a list of all their customer names and addresses, those hackers will then know your identity, address and that you own enough bitcoin to make owning a hardware crypto wallet a priority. Not good for your safety!

A simple and free way to do this is to create a brand new Proton Mail account that you only access via Tor Browser. Then use this one time email (and a fake name) to purchase the Hardware Wallet online with Bitcoin (preferably over the Lightning Network).

While finding a delivery address that’s not linked to your identity can be a bit harder, there are many options like PO Boxes, delivering to a work place or some other temporary location.

Types Of Bitcoin Wallets

There are a number of different wallet types out there:

- Hot Wallet: A wallet that runs on any online computer, phone, exchange or other program and has no hardware wallet protection. They can be custodial or non-custodial and most Bitcoin wallet software out there is a hot wallet. As the private keys are kept in the software, they are highly vulnerable to malware or hackers. It is recommended not to keep a large amount of funds in hot wallets.

- Cold Wallet: A wallet that runs on any online computer, phone, exchange or other program and has hardware wallet protection. They can be custodial or non-custodial and as the private keys are kept physically separate from the software, they are highly resistant to malware or hackers.

- Mobile Wallet: A wallet that runs exclusively on your phone. They can be custodial or non-custodial and even integrate with a hardware wallet device via USB or Bluetooth for added security. Some examples include Electrum, Nunchuk and BlueWallet

- Browser Extension Wallet: A wallet that runs exclusively in a web browser extension program. They can be custodial or non-custodial but are usually non-custodial and don’t use hardware wallet protection. As the private keys are kept in the software, they are highly vulnerable to malware or hackers. It is recommended not to keep a large amount of funds in browser extension wallets.

- Exchange / Web Wallet: A wallet that runs in a website, similar to how a bank runs your bank account. These are usually custodian and don’t use hardware wallet protection. They also introduce third parties (the ones that own the website / exchange) and thus bring even more risks. It is recommended not to keep any amount of funds in exchange or web wallets. Some examples include Coinbase, Binance, Blockchain and BitGo

- Desktop Wallet: A wallet that runs exclusively on your desktop computer. They can be custodial or non-custodial and even integrate with a hardware wallet device via USB or Bluetooth for added security. Some examples include Sparrow, Electrum and Specter.

- Multisig Wallet: A wallet that can only spend the funds when multiple private keys are used together, instead of a single key, avoiding a single point of failure. These private keys can be spread across multiple software and/or hardware wallets, each with their own single private key. They are usually non-custodial, but there are some services which can take custody of one of the multiple private keys for additional security called multicustodial wallets. They are the most advanced wallet type and introduce a few extra complexities in order to increase the security. For example a 2-of-3 multisig wallet might have your private keys spread across three separate hardware wallet devices. Any two are required to move the money but the loss of any one does not result in loss of money.

What To Consider When Picking A Bitcoin Wallet

As you can imagine, with the number of wallet options, features and preferences things gets pretty complicated fast. Should you use a single signature or multisignature setup? Which hardware crypto wallet device should you buy? Do you even need one at all?

To begin with, we strongly recommend downloading and installing Sparrow Wallet. It’s completely free and our guide has a full run down of how to install it, set it up, how to create your first wallet, spend and more.

>> Learn More: Sparrow Wallet Ultimate Quick Start Guide

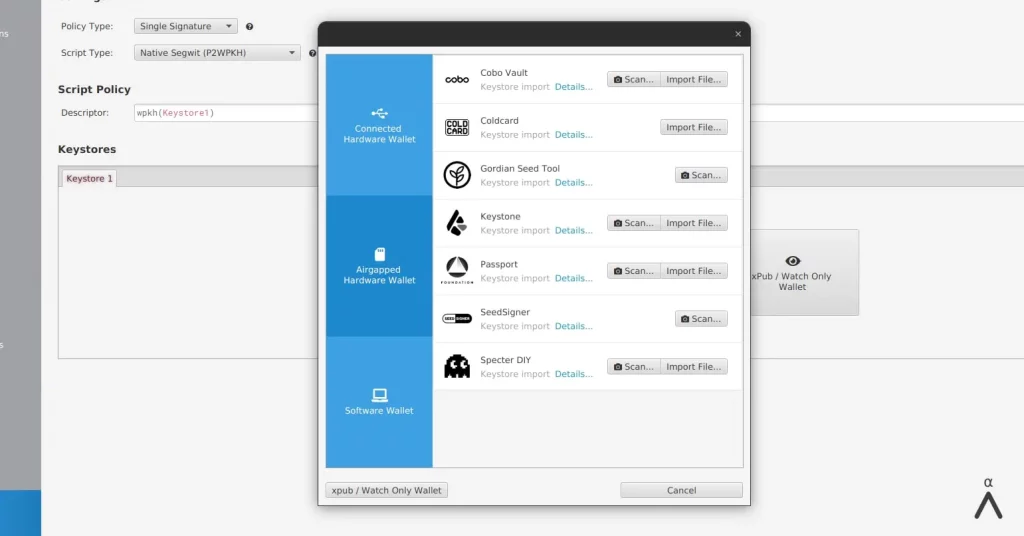

The good news is that there’s a lot of really good standardization and support for things across most wallets. For example Sparrow Wallet allows you to create software wallets (as shown in the example at the start of this article) or you can create a hardware crypto wallet using any number of supported 3rd party hardware wallet devices such as BitBox, COLDCARD or SeedSigner.

When choosing your Bitcoin wallet try to make sure it’s:

- Non-Custodian: Make sure you always have full control of your private keys

- Reputable: Make sure you fully research and vet the wallets reputation and history. There have been many cases of malware disguised as wallets that steal your bitcoins (especially on mobile App stores), so do your research carefully before deciding which one to use and trust. This also goes for any hardware crypto wallet devices you use

- Standardized: Make sure it supports the BIP39 standard and is generally not proprietary. Ideally you want it to be open source software that has been vetted by trusted security audits and the bitcoin community over many years

- Verifiable: Make sure it allows you to verify the signature of the manifest files with PGP keys as well as a shasum to confirm the authenticity of the binaries. This ensures that the software files you’re downloading are actually from the developers and haven’t been secretly replaced by hackers. An example of this info can be seen here and we go through the full process in our install guides above

- Backup: Make sure it has robust backup and restore capabilities built into it

There are many more features that wallets have such as fee control, Coin Control, password protection, Tor and Full Node connectivity and more. We will be covering all of this in future pieces so stay tuned!

Seed Phrase Security

One final, fundamentally critical thing to understand is that anyone that has your seed phrase can use it to create the same wallet on a different computer and steal your bitcoins, even if you have a hardware crypto wallet.

As such, you must not only guard the software/hardware crypto wallet, but also the seed phrase too.

Over the years, it’s been found that one of the best ways to store and secure your seed phrase is by using a pencil and laminated paper. If your computer crashes or is stolen you can find the piece of paper with the seed phrase on it and restore the entire wallet, saving any funds inside it.

All good wallet software will ask you to write down the seed phrase of the wallet it generates and most also test you afterwards to ensure it’s written down correctly. When doing this:

Make sure it never interacts or is entered into any computer device, ever!

Many printers have internal storage (even hard drives) that preserve copies of printouts. This is a risk if someone gets access to your printer, or if you dispose of your printer. There is also the possibility that a smart enough printer can be hacked.

Once again, there is a lot more to this that we cover in our deep dive pieces such as our Beginners Guide To Bitcoin Privacy or our Guide To Advanced Bitcoin Privacy.

FAQ

Do I Need A Wallet For Cryptocurrency?

Yes. In order to interact with the Bitcoin network (and all other cryptocurrencies like Bitcoin) you need your private keys and some software to use them to confirm received transactions as well as to broadcast new transactions.

Which Bitcoin Wallet Is the Safest?

Security is a spectrum. What one person (with $100 in bitcoins) considers “safe” might be horrendously unsafe for another person (with $100,000 in bitcoins). Generally speaking though, if you have an amount of funds that you don’t want to lose, ensure your wallet ticks all the points under the above “What To Consider When Picking A Bitcoin Wallet” section.

What’s A Bitcoin Address?

A Bitcoin address is a string of 26-35 alphanumeric characters that’s used to receive bitcoins. You can learn more about them in our post What Is A Bitcoin Address

What’s A Fiat Wallet?

A fiat wallet is a place where you digitally store, send and receive a fiat currency. You can learn more about them and why they’re a threat to your privacy and security here: What Is A Fiat Wallet?