While the main difference between Bitcoin and Bitcoin SV is how many transactions each of them can process per second, more isn’t always better. This becomes painfully clear if you actually understand blockchains. Simply shoving more and more transactions into a block has very real, and very serious consequences for the network and its security.

As a result, it’s easy for newcomers to get swept away in bigger numbers, faster settlement and more all without fully understanding those consequences. This means they end up wasting their time and money buying into what is essentially a cheap knockoff of the original. Don’t let it happen to you!

Contents

What Is The Difference Between Bitcoin And Bitcoin SV?

The main difference of Bitcoin vs Bitcoin SV is the block size. While Bitcoins block size was originally set at 1 MB by its creator Satoshi Nakamoto (and then raised to 4 MB later on), Bitcoin SV was set to a much higher value in order to enable it to handle more transactions.

| Bitcoin | Bitcoin SV | |

|---|---|---|

| Purpose | Trustless Money | Trustless Money |

| Symbol | BTC | BSV |

| Creators | Satoshi Nakamoto | Craig Wright, Calvin Ayre |

| Launched | Jan-2009 | Nov-2018 |

| Consensus | Proof-of-Work (SHA-256) | Proof-of-Work (SHA-256) |

| Block Size | 1 MB -> 4 MB | 128 MB -> 2 GB -> Infinite |

| Block Time | 10 min | 10 min |

| Transactions | 7/sec | 50,000/sec |

| Supply | 21 Million BTC | 21 Million BSV |

What Is Bitcoin SV?

Bitcoin SV (Satoshi Vision) is a hard fork of Bitcoin Cash (BCH), which itself was a hard fork of Bitcoin. Its cryptocurrency BSV and blockchain are very similar to Bitcoin with the main difference being that the size of its blocks are much bigger.

>> Learn More: What Is A Bitcoin Fork?

Created by an Australian computer scientist called Craig Wright in November 2018, it aimed to increase the block size so that more transactions could be handled. This would mean Bitcoin SV could be used as a global cash and thus, fulfill the “vision” of the original Bitcoin Whitepaper written in 2008 by Satoshi Nakamoto.

Block Size And Network Security

To understand why Bitcoin SV (and Bitcoin Cash) exist, it’s important to first understand the relationship between block size and network decentralization and security.

Block size is simply just how big each block in the Blockchain is allowed to be. Maybe it’s 1 MB. Maybe it’s 32 MB. It can be any number really, but just like the number of shots you take at a raging party, everything comes at a cost.

The larger the block size, the more transactions you can fit in it and the faster Transactions Get Confirmed, it also means lower fees too. While this all sounds fantastic, the larger the block size, the larger the blockchain. The larger the blockchain, the more costly it becomes to run a Full Node which must store the whole blockchain. This increased cost means fewer people run nodes which means the network is less decentralized and thus, less secure.

Larger Blocks = Larger Blockchain = Higher Node Costs = Fewer Nodes = Less Secure

To help demonstrate this important concept, imagine it’s 2018 and you want to run a node for Bitcoin (4 MB block size) and Bitcoin SV (128 MB block size). Each blockchain mines a block around every 10 minutes. Let’s see how much the blockchain could grow in size over the course of just 1 year assuming every block is filled up 100%:

Bitcoin: 4 MB x 6 (blocks per hour) x 24 (hours in a day) x 365 (days) = 205 GB / Year

Bitcoin SV: 128 MB x 6 (blocks per hour) x 24 (hours in a day) x 365 (days) = 6,570 GB / Year

As you can see, running a Bitcoin SV node is really expensive! You have to continuously expand your hard drive storage space by about 6.5 TB every year! This makes node operation expensive and more technical, thus reducing the number of people who are willing to do it, which reduces decentralization and network security.

>> Learn More: Why Run A Bitcoin Node?

There’s also additional issues when you increase block size such as:

- Increases in bandwidth costs in order to download / upload more transactions

- Increases the time to “sync” a new node as the blockchain download time is longer

- Increases CPU costs as there’s more transactions to validate

The Blocksize War

This simple relationship between block size and network security led to endless debates and culminated in the Blocksize War. A clash between many in Bitcoin that resulted in the first hard fork of the Bitcoin code base into what’s now known as Bitcoin Cash in August 2017.

Bitcoin Cash (BCH) has a block size of 32 MB. Not happy with even this considerable increase, Craig Wright along with billionaire Calvin Ayre hard forked BCH to create Bitcoin SV (BSV) which had a block size of 128 MB.

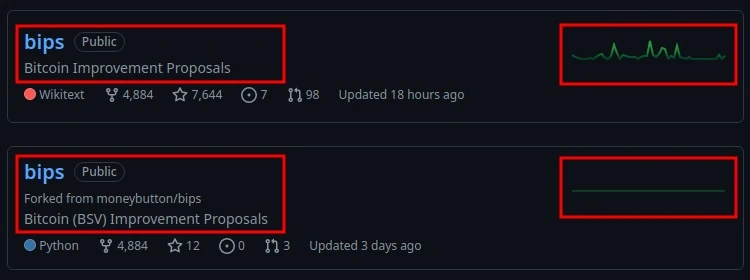

While these two hard forks are absolutely an improvement in transaction speed, the lack of decentralization due to fewer full nodes in the network not to mention no developers working on the code base as shown above in the activity of each projects Bitcoin Improvement Proposals (BIPs) has led to them becoming essentially irrelevant.

As of writing, Bitcoin Is Worth more than 150 times the other two networks combined. As such it’s clear which one the market thinks is more valuable.

Furthermore, with the introduction of the Lightning Network, Bitcoin is now also capable of being sent near instantly and with zero Transaction Fees too. All while maintaining it’s low block size and incredible network decentralization and security.

>> Read More: Bitcoin, Not Crypto

What Is Bitcoin SV Used For?

Due to its much larger block size Bitcoin SV can handle a much higher transaction throughput. This, along with its support for Smart Contracts (via its sCrypto coding language) allows it to be used for micro payments, games, NFTs, Apps and more.

On their official website, they list hundreds of projects within the BSV ecosystem with everything from chat applications to e-commerce. Along with these newer uses, you can also use it for many of the other things you can use Bitcoin for such as buying goods and services as well as transacting in general.

New to Athena Alpha? Start today!

How Does Bitcoin SV Work?

Just like Bitcoin, Bitcoin SV uses the Proof-of-Work (PoW) mining algorithm to secure the network and mint new coins. It also chains blocks together by ensuring any new blocks have a hash of the previous block before it and has a cap of 21,000,000 coins.

While Bitcoin SV originally had a block size of 128 MB, a network upgrade in July 2019 increased it to 2 GB and then in February 2020 the Genesis upgrade completely removed the hard cap size entirely. Bitcoin SV also supports smart contracts which the original Bitcoin blockchain does not.

Bitcoin Vs Bitcoin Cash Vs Bitcoin SV

When it comes to BTC vs BCH vs BSV there’s a lot of history and a lot of major differences. As stated though, the biggest one is the block size between them all and throwing Bitcoin Cash into the mix doesn’t really change much.

| Bitcoin | Bitcoin Cash | Bitcoin SV | |

|---|---|---|---|

| Purpose | Trustless Money | Trustless Money | Trustless Money |

| Symbol | BTC | BCH | BSV |

| Creators | Satoshi Nakamoto | Developers | Craig Wright, Calvin Ayre |

| Launched | Jan-2009 | Aug-2017 | Nov-2018 |

| Consensus | Proof-of-Work (SHA-256) | Proof-of-Work (SHA-256) | Proof-of-Work (SHA-256) |

| Block Size | 1 MB -> 4 MB | 8 MB -> 32 MB | 128 MB -> 2 GB -> Infinite |

| Block Time | 10 min | 10 min | 10 min |

| Transactions | 7/sec | 116/sec | 50,000/sec |

| Supply | 21 Million BTC | 21 Million BCH | 21 Million BSV |

The Athena Assessment

The most important take away is not that they have different visions or transaction throughput, it’s that Bitcoin the network along with all its network effects, world wide branding, developer devotion, market liquidation and more can’t simply just be “copied” by anyone.

It doesn’t matter if a bunch of miners all band together because they want to get more mining fees. It doesn’t matter if you’re a billionaire and can put hoards of advertising and cold hard cash behind it. Bitcoin cannot be copied.

Bitcoin is orders of magnitude bigger than any of its competitors. Money is also a winner takes all environment and just like no one uses Bing (apologies to the 4 of you out there) no one else is using anything but Bitcoin for a Store Of Value or stateless money. Its unique creation, community, size, brand name and liquidity are all unmatched and will only further increase due to these advantages.

The final nail in the coffin for any existing and future “we need faster transaction” hard forks is that we now also have the Lightning Network. This layer 2 network sits on top of the Bitcoin base layer and allows for near instant and free payments, achieving exactly what both Bitcoin Cash and Bitcoin SV originally wanted in the first place. All without hard forking Bitcoin.

FAQ

Is Bitcoin SV the real Bitcoin?

No. While anyone can copy the Bitcoin Core code base, they cannot copy the world wide branding, market liquidity and developer following of the Bitcoin network. As Bitcoin SV is a hard fork of the original Bitcoin code that doesn’t align with the rest of these features of the network, it means it’s not the “real” Bitcoin.

Is Bitcoin SV The same as Bitcoin Cash?

No. Bitcoin SV is a hard fork of Bitcoin Cash, which itself was a hard fork of Bitcoin. There are a number of differences in the network and code with the main things being block size and overall vision for the protocol.

will bitcoin sV overtake bitcoin?

While anything can happen… it’s highly unlikely that Bitcoin SV will ever surpass Bitcoin in any meaningful way. This is because Bitcoin has more developers, more world wide branding reach, more market liquidity and a much bigger lead when it comes to its network effect.

Why is Bitcoin SV not tradable?

Bitcoin SV was created by an Australian computer scientist called Craig Wright in November 2018. Over the years he has created significant controversy by claiming that he is Satoshi Nakamoto, creator of Bitcoin. This, along with many other actions including law suits, has led many exchanges to delist Bitcoin SV.