Keeping your financial activities and personal information private is a basic human right. Random people or companies shouldn’t know what you use your money for or how much you have. Yet Chain Analysis and their ever constant tracking of your personal business is only getting more invasive by the day.

While Bitcoin does allow for a huge increase in privacy over the legacy financial system, it’s important you’re aware of chain analysis firms, what they do, how they do it and what steps you need to take to ensure that your private financial information isn’t sucked up by their huge data mining operations.

Contents

What Is On Chain Analysis?

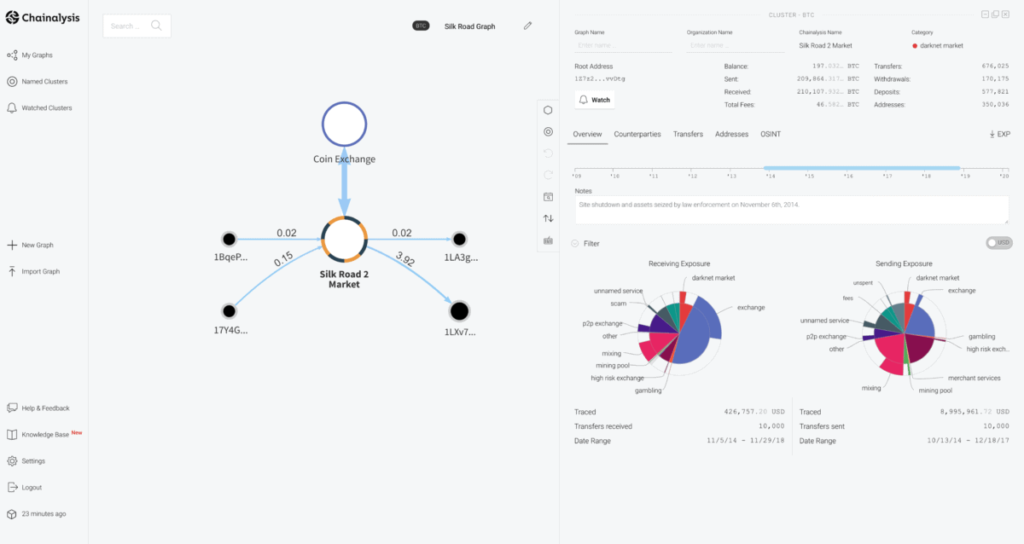

Chain analysis is the surveillance of the Bitcoin Blockchain and application of various heuristics to try and give a best guess as to who likely owns what bitcoins. This is possible because the Bitcoin blockchain is open and free for anyone to view.

While chain analysis was initially used by traders or investors to get insight into how the Bitcoin network was growing or acting, it has since grown into a massive new industry that interacts with law enforcement and government on a daily basis.

These chain analysis firms not only collect public Bitcoin network information such as transaction size, wallet addresses, history of bitcoin movements and personally identifiable information, they also sell this information to various third parties for marketing or demographic purposes.

For example, some investment hedge funds might pay them to get a list of the names and addresses of who owns all the Bitcoin Wallets that contain over 1,000 BTC in them.

When seeking an expert level in Bitcoin Privacy you’ll want to be fully aware of how on chain analysis firms work, what we’re up against and what you can do to ensure their job is as impossible as it can be. This will also help increase your security too.

On-Chain Analysis Is Serious Business

To start with, these are serious businesses. Very serious. Have a quick visit and read over Chainalysis website and you’ll quickly get the message. These firms interact with the highest levels of Crypto Exchanges and international government departments to track funds across every blockchain, cryptocurrency, DeFi protocol, continent and more.

They’re not the only one either, there are a number of other companies, such as CipherTrace, CipherBlade, BlockSeer, and Elliptic. All of these companies have specialized in the development of complex and expensive software to help law enforcement and other exchanges when it comes to investigations of theft or money laundering.

While we can absolutely get behind many of the core reasons for doing this type of analysis such as recovering users stolen funds, stopping terrorists and criminals, the reality of history seems to indicate that the small wins these systems do enable come at an incredible cost to everyone’s privacy, security and general freedoms. Which is unacceptable. It’s akin to locking everyone inside their house permanently so that we’re all “safe”.

It’s perfectly understandable for a company to want to ensure that they’re not taking part of criminal activities, but the solution to this age old problem isn’t to invade everyone’s privacy by cataloguing their every purchase, trade and transfer and cross referencing it against a secret databases of “bad” addresses. Doing so is just as silly as strip searching every person that drives through your toll road.

How Chain Analysis Works

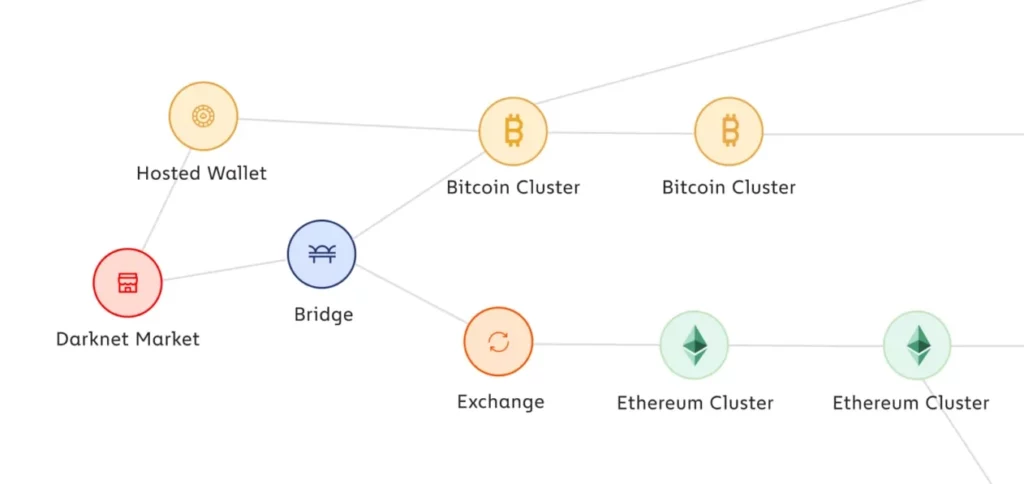

Chain Analysis firms work at a basic level by combining the open details of the Bitcoin Blockchain together with more proprietary and secret information they get from law enforcement, governments, Crypto Exchanges, merchant service providers and their own databases of known Bitcoin Mixer services and historically meaningful addresses that they track.

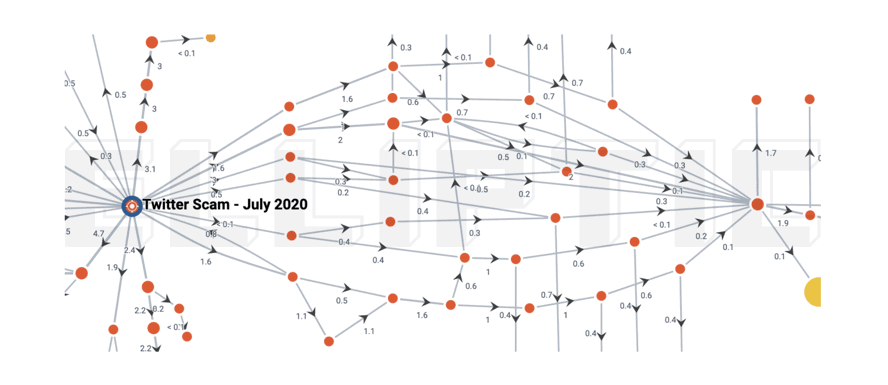

For example they may trace a new bitcoin transaction tagged in a ransomware crime that goes through a mixing service, through many other wallets, into an exchange and then help law enforcement to understand this process and what it ultimately means for their investigation.

CipherBlade collaborates with the FBI on a nearly daily basis, and holds regular discussions with varied law enforcement and regulatory entities

CipherBlade

Their on chain analysis tools also identify exchange wallets based on the patterns of incoming and outgoing transactions and often require manual review. This review is done by trained experts as following the flow of funds can be very tricky and lead to a lot of false positives if the person isn’t experienced and understands how everything works.

At a higher level, there is considerable maths that gets involved in things like how statistically likely that address A is owned by the same person as address B given transaction C. While some things are very black and white it can quickly turn into a mess of exponentially diverging addresses, transactions, wallets and more.

They use AI, data sharing, transaction labeling and unique flow diagrams to help with the process, but ultimately it can get very complicated very quickly and it’s easy to make mistakes that lead one down the wrong path and to the wrong conclusion.

Ironically, in one of their own blog posts they point out multiple ways of how other “novice investigators” can make critical mistakes that lead to them investigating and sending subpoenas to the wrong people or companies. All without noting that they themselves are likely making many other mistakes too.

New to Athena Alpha? Start today!

Chain Analysis Isn’t Bullet Proof

The process of tracking funds is quite technical and involves thousands of different companies and agencies all across the world. Bitcoin moves at the speed of light, but bureaucracy definitely doesn’t!

While they might get data from exchanges, this isn’t a silver bullet. This is because, like banks, when users deposit funds into an exchange the exchange business typically moves and co-mingles it with other users funds. Whether it’s to reduce their transaction fees, streamline their trading activities or just to move a bunch of funds to cold storage for protection, it’s a common and logical thing to move funds around and mix them a lot.

While the exchange might precisely track that user A bought $100 in Bitcoin and then sold it to user B at a later date, the mixing of those bitcoins and fiat funds in between those two events for business efficiencies or security reasons might not be so clear or even logged.

Maybe they don’t keep logs at all as there’s no requirement in the country they operate in. Maybe the on chain analysis firm doesn’t have an agreement with that specific exchange company to get all their private data. Maybe the exchange is engaging in criminal activities themselves and thus, prefers not to keep detailed records that will incriminate them!

The point is, there’s a lot of reasons why precisely tracing funds can be potentially impossible. Even if the chain analysis firm has all the data (somehow) then they also must be able to prove that the conclusions they’re coming to are accurate.

For example, if they are tracking criminal funds of 1 BTC and it gets split into 0.5 BTC and 0.5 BTC… does the owner of the original 1 BTC now own 0 BTC, 0.5 BTC or 1 BTC? While there are many heuristics that give statistical probabilities to these sorts of simple questions they’re rarely 100% certain.

How To Protect Your Privacy

Now that we better understand how Chain Analysis firms work we can do a better job of protecting ourselves from their prying eyes. We are dedicated to helping you learn about and increase both your Privacy and Security here at Athena Alpha. That’s why we have comprehensive guides at multiple levels for each:

- A Beginners Guide To Bitcoin Privacy

- A Guide To Advanced Bitcoin Privacy

- A Guide To Expert Bitcoin Privacy

- A Beginners Guide To Bitcoin Security

- A Guide To Advanced Bitcoin Security

- A Guide To Expert Bitcoin Security

- How To Protect Your Crypto: An Ultimate Guide

- Hardware Wallet Risks

All of these guides will dramatically help you protect yourself from these on chain analysis firms, not to mention the prying eyes of general companies, governments, hackers, scammers and other serious risks that are out there.

Looking specifically at stopping chain analysis firms though, we would recommend the following:

- Don’t Reuse Addresses: Each time you receive funds it should go into a brand new address

- Self-Custody Your Coins: Hold your own Private Keys and keep them safe

- Don’t Use KYC Exchanges: Always trade bitcoins using non-KYC Crypto Exchanges

- Use Your Own Full Bitcoin Node: Build or buy your own node and connect all wallets to it

- Use Tor: Ensure your node and all wallets only connect over Tor or a private VPN

- Separate Funds: Use separate wallets for KYC and non-KYC funds

- Use The Lightning Network: Use a separate wallet over Lightning to purchase daily goods

- Use Coin Control & Labeling: Label and be selective about which sats you spend

- Don’t Dox Yourself: Never associate your real world identity with any of your addresses

- Fade Away: Progressively remove and scrub away any mention of Bitcoin in your life

- Encrypt Everything: From chats to HDDs to phone calls, make sure everything is encrypted

- Self Host Everything: Stop relying on other peoples computers and host your own data

FAQ

What Are The Tools For Onchain Analysis?

Many of the best tools used are proprietary and owned by the various chain analysis firms that are in the space. However you can do very basic chain analysis simply by using a block explorer website such as Mempool.space and entering in a transaction ID or address.