Are times tough for you right now? We’re pretty sure they are.

You’ve probably got a million things on your mind worrying you. Financial stability is wonky, debts are high, banks are failing left and right, inflation is going crazy, you’re always saving as much as you can but a secure future still seems like a pipe dream. It’s really, really stressful and demoralizing.

So with all this pressure, why should you or anyone else learn about Bitcoin?

Because it could be your golden parachute out of this dumpster fire of a world that’s pushing wealth inequality to absurd levels. A beacon of hope in a sea of never ending debt and legacy financial BS.

Contents

Our Current System Is Rigged

It’s no secret that the current financial markets are rigged. There, we said it. Things are broken, corrupt and grossly over manipulated by the elites and their many paid for politicians. But. There is still a way to shelter yourself and family from this ever disintegrating financial environment.

From the oil markets run by literal cartels to politicians dumping stock days before their decisions tank the market. It’s gotten so obvious now that they have to gaslight people by trying to change the meaning of well established words like “recession”. They print trillions of dollars and try to cover it up by calling it fancy, seemingly complicated names like Quantitative Easing (QE).

The fact that they can even do this in the first place – conjure money out of thin air – should raise a pretty big red flag. You can’t just snap your fingers and generate real things, which should tell you that the money they’re creating isn’t real either. We all seemingly “know” that the emperor isn’t wearing any clothes, but the wider public just hasn’t accepted it yet.

If you follow financial news you’ve likely heard of Bitcoin. As experts on the subject we can confidently say that whatever you might think you know about Bitcoin, there’s more to it. If all you’ve heard of Bitcoin is that it’s for criminals or a bubble or a scam, then we can safely say you’ve been mislead.

Bitcoin is very different to what most people are used to. It’s something that might seem simple on the surface, but that has layers and layers of genius and wonder emerge as you peel each one back. What role Bitcoin ends up playing in the world is still being discovered, but currently it’s most widely accepted use case is for a Store Of Value.

If you’re interested in Bitcoin, then you might want to consider getting some. A few years ago it was much harder to stack some sats (tiny parts of a bitcoin) than what it is now. Buying some not only lets you rally against the current corrupt system, but also enables you to be an early adopter of an excellent money and learn about it all in one.

Why Should People Learn About Bitcoin?

This isn’t a piece that tells you how Bitcoin works. We have lots of excellent resources below for that, this is more about the why. So why should someone learn about Bitcoin? Why should you take time out of your busy day to read up on this “scam” as the Bitcoin Myths would put it?

There are multiple reasons that each appeal to different people. For some, the fact that it’s an utterly genius level new technology is simply interesting in itself. For others it’s that it combines many disparate disciplines like cryptography, finance, game theory and more all in one. Many others are just attracted to its legendary “number go up” (NgU) technology.

We can’t say which of the many reasons will appeal the most to you, but as we care about the horrendous wealth inequality in the world and helping people, we can’t help but make the recommendation.

If you’re interested in finance (or do it for a job) then you’ll definitely want to learn about Bitcoin because leading establishments such as Yale have already recommended it be a part of everyone’s portfolios. Add to this the recent launch of the Bitcoin ETFs, which were the biggest in the history of any ETF, and it doesn’t take a genius to realize that it’s not just a passing fad.

If you’re interested in history then you should approach it from the perspective of learning about the history of money throughout the ages and why Bitcoin was brought into the world in the first place. It’s a fascinating tale of countless researchers, open source work, cypherpunks and a mysterious now billionaire inventor(s) that disappeared.

>> Dive Deeper: When Did Bitcoin Come Out & The Captivating History Of Bitcoin

Whatever path you approach Bitcoin from, nothing helps a person learn faster than by doing. Which is why we also recommend you start stacking sats as soon as possible.

Stack Sats, Now!

Buy Bitcoin? But aren’t you already late? No.

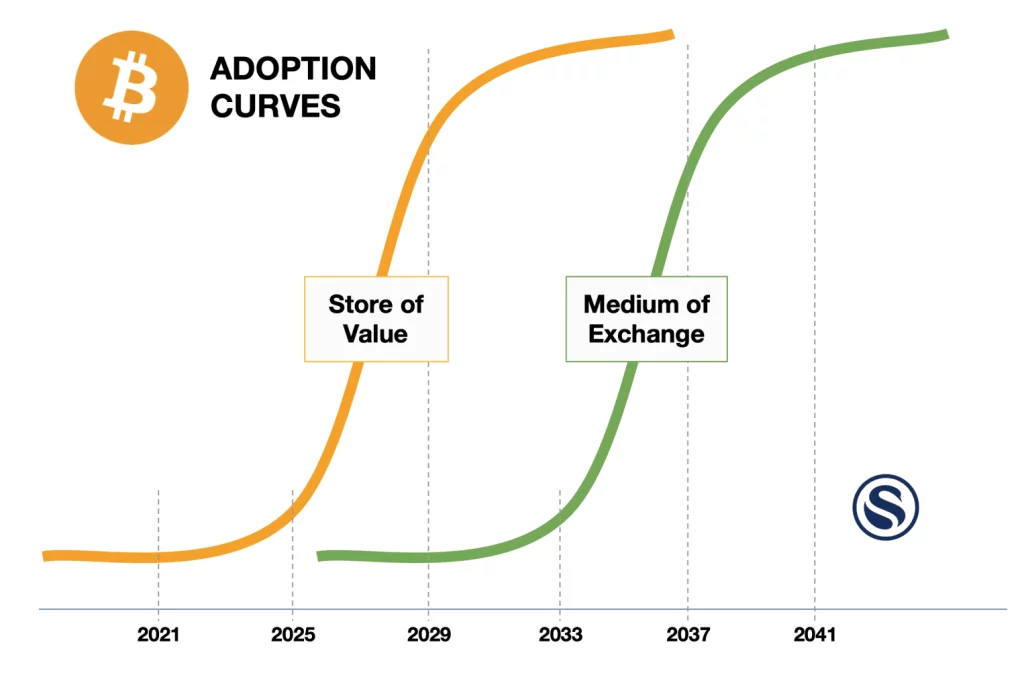

While you might never think about how a new money becomes money, there is in fact a well established path that they’ve all historically gone through. We won’t go into too much detail here, but generally a new money like Bitcoin goes through four stages:

- Collectable: To begin with, a money is wanted simply because it’s got a strange property to it. Maybe it’s really shiny or different or just appeals to the person for whatever reason. Think of things like glass beads, shells or even gold. The thing is interesting so people collect it

- Store Of Value: As more and more people collect the new thing (and it persists over time) it starts to be recognized as a way to store value for long periods of time. As more and more people figure this out, demand for the money increases and it becomes more valuable which leads to more demand, more production of the money and so on. Depending on the demand and supply dynamics, the value of the new money can be highly volatile through multiple supply and demand episodes. This is the stage Bitcoin is currently in and why it’s so volatile. As this demand is finally saturated the increasing value will plateau, making its value more stable which allows the next stage to begin

- Medium Of Exchange: During the Store Of Value stage it makes sense to hold onto your new money, as by doing so it will buy more at a later time. Once the purchasing power of it has stabilized though this logic no longer applies and people will be more open to spending it on goods and services. The Medium Of Exchange stage is what most normal people ascribe to “money” these days and is where people trade and spend the money on a daily basis

- Unit Of Account: As the new money is used by more and more people and acceptance of it grows so too does it get integrated into the financial systems of the world. Accounting software gets updated to include it. Shops sell their goods denominated in the new money instead of the old. Most importantly, these people no longer buy the new money simply to exchange it for another one later on. When people accept Bitcoin and don’t refer to its value as “$____ USD per bitcoin” then it will have reached this final stage

While you might think you’re late to Bitcoin, we’re not even close to leaving the second stage yet! There’s currently an estimated 300 million or so users of Bitcoin world wide, less than 4% of the world.

The market cap of Bitcoin as of writing is around $1,360 billion. Gold (another store of value money) is roughly 11x bigger and there’s many other asset classes that Bitcoin can suck tremendous amounts of capital out of including real estate, bonds and stocks.

While precise dates for when Bitcoin achieves these different stages of money obviously isn’t known, its growth is accelerating and has even surpassed the Internets adoption pace.

Bitcoin is a technology after all and so will follow the standard S-curve adoption shown above. Our estimates are inline with Swan’s which is that the store of value stage should saturate over the next 10 years or so.

How do we recommend stacking sats? The same way any responsible person might recommend accumulating an asset: not trying to time the market and instead buying regular amounts often (also called Dollar Cost Averaging).

As noted, Bitcoin is very different to what you’re likely used to. It’s easy to get scammed, hacked, tricked or lose access to your bitcoins. It’s not difficult, but care does need to be taken. Don’t mistake our eagerness for recklessness. You should absolutely be cautious, start small, go slow and most importantly, educate yourself. Here are some resources to get you started:

- What Is A Bitcoin?

- Understanding Bitcoin

- 10 Awesome Bitcoin Tips For Beginners

- What Can You Do With Bitcoin?

- What Is A Bitcoin Address?

- What Is A Bitcoin Wallet?

- What Is Bitcoin Mining?

- A Beginners Guide To Bitcoin Privacy

- A Beginners Guide To Bitcoin Security

- How To Invest In Bitcoins

Why Does The World Need Bitcoin?

While corrupt financial markets and money printing continues so too will the theft of your wealth.

When central banks of any nation print more and more of their currency, they devalue the currency for everyone. If you hold $100 in a bank or under your mattress and they double the money supply then that same $100 is worth less.

It buys fewer goods or services. They have stolen some of its purchasing power from you buy printing “free” money which disproportionately goes to their wealthy friends.

Eventually this endless printing leads to hyperinflation and the death of the money in question. This has happened time and time and time and time again, even to world leading economies. Bitcoin has the power to put an end to this and usher in a global renaissance with a world wide, universally accepted sound money for all that cannot be inflated by anyone.

On a more practical level, Bitcoin right now allows anyone to:

- Spend it. You can spend it at hundreds of thousands of places all over the world

- Store monetary value over time. Bitcoin isn’t inflated away at 2-3% (or 3.4%+ at the moment!) each year. Simply keeping your money stored throughout time (from 10-100 years) and it not being siphoned away or debased by inflation is a major Bitcoins use

- Store monetary value without anyone’s permission. While this might seem like a trivial thing to be able to do to anyone that has a bank account in a first world country, billions of people in the world cannot get a bank account and thus, can never save their money long term, send it to others or receive it for activities like running a business. With Bitcoin, this is now free for anyone with a smartphone to use forever

- Store monetary value beyond the reach of a government. For those in first world countries, this again isn’t a big concern as currencies like the US Dollar or the Euro don’t suffer from hyperinflation. For 4+ billion people under authoritarian regimes or double or triple digit inflation this is a critical use. Most of these people have no choice but to use the currency of their country, currencies that are often seized by tyrants, inflated away to nothingness or just declared worthless overnight. Bitcoin gives them a choice and a impenetrable safe storage place for the first time in history

- Send money overseas instantly and cheaply. If you’ve ever tried to send someone overseas $10 (or even a larger amount) you’ll know how difficult, slow and costly that “simple” exercise can be. It involves multiple banks, currency conversions, fees and intense privacy invasive “checks”. By contrast, with Bitcoin you can send anything from $1 to billions of dollars with final settlement occurring in minutes and for cents

- Send free and instant Remittance. Remittance is a multi-billion dollar industry that charges horrendous fees (5%-50%) and takes weeks over the legacy financial rails. With Bitcoin and the Lightning Network remittance can be instant and free for everyone. Being entirely online it also saves people from having to travel for hours every week just to withdraw the money from a physical location where they have a high chance of being robbed

- Transact without being banned. While you might think of terrorists or drug lords as the only “baddies” being banned by banks, there are many countries where simply being female means you cannot have a bank account. Sex workers (and even those simply discussing sex) are also often banned or demonetized. Bitcoin allows for them to transact and have access once again

- Take their wealth with them when fleeing a country. Even in Europe, fleeing a war torn country isn’t off the table these days and with Bitcoin you can take any amount of wealth with you either with a Hardware Wallet or by even just remembering 12 short words

That’s not all either, there are Layer 2 applications built on top of Bitcoin that enable instant and near free transactions of fractions of a cent enabling creators to charge for their content by the page, second, podcast, video, minute and many other things too.

While the practical use cases above are many and concrete, its most important use case is to stop your hard earned money being devalued daily. You worked hard for that money. You gave up your time, your life for that money and no one should have the power to rob that from you. Bitcoin fixes this abuse of trust at its root.

The Best Money We’ve Ever Had

This power to dilute the purchasing power of everyone else by printing endless money is a power that all governments and third parties abuse eventually. Bitcoin is different as there is no CEO, no “bitcoin company”, no Bitcoin central bank. It’s money built by the people, for the people and what a money it is.

You can choose anything to be “money” like a rock or a cow. Whether or not it’s considered as a good type of money and then valuable depends on how well it hits all the characteristics of money. This is no different to how a phone that can record 8K video, surf the web on a big screen and stream Spotify makes for a more valuable smartphone than a brick phone from the 1990’s. The main six characteristics of money are:

- Scarcity: Limited in supply relative to other things

- Durability: Can be used many times and still function, stands the test of time

- Acceptability: Is used and accepted by many other people

- Portability: Easily moved across long distances

- Divisibility: Easy to divide into smaller units to make trading more practical

- Fungibility: One unit is exactly the same as another unit

Historically, people have used many different physical items as money such as seashells, tulips or Rai stones, but throughout all of it the most enduring form of money has been gold.

Now that we understand what makes a “good” money we can use these definitions to compare some of the top monies that have ever been used over time to the new hotness, Bitcoin.

| Fiat | Bitcoin | Gold | |

|---|---|---|---|

| Scarcity | Low | High | Medium |

| Durability | Medium | High | High |

| Acceptability | High | Medium | Low |

| Portability | Medium | High | Low |

| Divisibility | Medium | High | Low |

| Fungibility | High | High | High |

As you can see, it’s a bit of a blood bath lol

The only characteristic that Bitcoin stumbles at is Acceptability which, as covered above, only comes to a money once it progresses through the Medium Of Exchange stage. If you’d like to dive deeper into these characteristics as well as the dimensions of money, check out What Is A Bitcoin Worth?

Bitcoin is amazing money. It’s better gold than gold. It’s natively digital. It can be backed up in a thousand redundant locations. It can be sent at the speed of light and much, much more.

Myths About Bitcoin

When searching for information about Bitcoin you’ll most likely get major news pieces about it from writers or legacy finance people that don’t properly understand Bitcoin and thus, give you poor and extremely incorrect information. We covered this in much more detail in our Debunking The Top 10 Bitcoin Myths piece.

The other main source is from private companies like big crypto exchanges that have big vested interests (eg. Coinbase, Kraken etc). They at least understand the technology, but are more often than not just thinly veiled ads to try and convince you to start day trading other cryptocurrencies so they can make money off you.

As a result of this duality of failure, all most people hear is fear, uncertainty, doubt (FUD) and incorrect information leading to a number of myths and misconceptions about Bitcoin. Let’s go through a few of the main ones:

Bitcoin is a bubble / too volatile: As we described above, during the Store Of Value stage of a money, it will often go through periods where supply and demand don’t align properly which causes high volatility. This in many cases can indeed create a bubble just like in any other market leading to endless headlines that “Bitcoin is dead!” when it bursts.

This doesn’t change Bitcoins underlying utility though and every time it has lived on. Another major source of volatility is how big the overall market of Bitcoin is. As the market cap of Bitcoin grows over time, it will be harder for rich people (whales) to influence the market.

The volatility of Bitcoin, while still quite high, has already come down over the years. It will no doubt still form bubbles as we go through more supply/demand crunches, but over the years Bitcoin has also always come out bigger and better. This is also why we recommend stacking sats in regular intervals.

Bitcoin is too expensive: Just like with shares, many people wrongly believe that you can only buy a whole bitcoin or suffer from unit bias. The fact is 1 bitcoin can be divided up into 100,000,000 pieces called Satoshi or sats. You can buy 1 sat, 1 million sats or 1 bitcoin the choice is yours. You can currently get about 5,000 sats for just $1.45. You’re not too late, you’re actually very early to the party.

Bitcoins transaction fees are too expensive: The fee you pay to send Bitcoin is chosen by you (not set by some faceless bank). Fees can be high during busy times or low (eg. $0.05 to move whatever amount you wish) if you don’t mind waiting an hour or two. If five cents is too expensive, you can also use the Lightning Network and pay fractions of a cent even if you only want to send $0.01 to someone.

Bitcoin is old technology: You should think about Bitcoin like you do the Internet. It’s not a single app or fad that’ll soon fade out of existence like some stupid TikTok meme, it’s a base layer protocol (like TCP/IP) for the entire world to store, send and receive money on. No one calls the Internet “old technology” or thinks someone else will come along and build a new “better Internet 2.0”. The same is true for Bitcoin. Just like everyone builds on top of the Internet, so too does everyone, everywhere constantly build on top of Bitcoin.

>> Learn More: Debunking The Top 10 Bitcoin Myths

Bitcoin will be replaced by the competition: While there might be 20,000 other cryptocurrencies (altcoins) they are not Bitcoin and will never be able to catch up. This isn’t just wishful thinking either, by many objective metrics Bitcoin is orders of magnitude bigger. This field is a winner takes all environment and just like no one uses Bing (apologies to the 12 of you out there) no one else is using anything but Bitcoin for a store of value. Its Network Effect (the most important advantage) is paramount, its creation unique all while its community, brand name and liquidity are unmatched. More details on why Bitcoins cannot be cloned or copied can be found under our Bitcoin Myths post.

Bitcoin is too complex: If you want to properly understand it at a fundamental level then yes, it can be complicated. But. So is email or a plane or your microwave and you can easily use them. One of our primary goals is to explain Bitcoin, simply, so if you feel this way please take some time to read more of our pieces. We have in depth and shorter, simplified versions such as How Does Bitcoin Work For Dummies?

The user experience for Bitcoin is also far easier than what most think, even easier than most banks in many cases, if you can download an app you can use Bitcoin. There are still some challenges, but developers all over the world are working daily to improve it.

The Real Risks

While there’s almost endless FUD about Bitcoin there are still real risks to holding it. While we’re obviously very bullish, we also don’t hide things. If there’s a real risk we’ll always tell you straight up. We don’t ignore negative things just because it doesn’t fit our world views.

You’re also skeptical too, we get it, we were too. We wasted years thinking Bitcoin was just some weird retard scam thing that the latest Instagram influensoor was peddling.

We were wrong. We have no problems admitting that. Only after studying the nuts and bolts of it were we able to fully realize what Bitcoin was about. The earlier you start, the quicker you’ll get it.

When you do and you trust it enough to start investing here are some real (non-FUD) risks you should be aware of:

- Volatility: Bitcoin’s still a highly volatile asset that changes price every second, every day

- No Insurance: Deposits in banks are usually insured by the government in case the bank goes bankrupt, Bitcoin has no backup or insurance policy

- Protocol Risk: Although the Bitcoin network, protocol and cryptography that secures it have been battle tested over the past 15+ years, it’s still always possible that someone, somewhere finds a design flaw. Quantum computers could also succeed where classical computing has so far failed to crack its encryption which may shatter the worlds faith in Bitcoin. That being said the protocol and code behind Bitcoin is quite possibly the most reviewed and hardened in existence. With a Market Cap of over a trillion dollars, this effectively serves as a “bug bounty” which anyone able to compromise the network would be able to claim. So far, no one seems up to the task.

- Fraud / Bankruptcy: While holding your own Private Keys secures you against this risk, many users still allow other third parties to custody their funds for them (or hold the private keys on their behalf). This trust in a third party such as a centralized exchange then exposes them to other risks such as Crypto Exchange Bankruptcies, being a victim of hacking, being shut down by a government or simply doing fraudulent things. To avoid this, it’s recommended you always remove your bitcoins from any exchange and hold your own private keys. This also greatly increases your Bitcoin Privacy too.

- Regulation: As Bitcoin is still very new, regulations are still quite unknown and are evolving as time goes on. As Bitcoin grows and draws more attention upon itself, regulation is expect to increase

- Hacking: While this is a risk with virtually all assets in today’s modern world, Bitcoin is often stored by the user and not a financial institution and as such, may not be secured as well if the user isn’t very technical. This can lead to users losing their bitcoins to any number of hacking tricks that wouldn’t otherwise be possible. It should be noted though that using a dedicated Hardware Crypto Wallet can significantly eliminate this risk.

- Fungibility: While the Bitcoin network sees all bitcoins as equal, countries, governments or even private companies may mark certain bitcoins. This mark may mean they don’t get processed by them or are otherwise censored in some way by merchants. You could still send/receive them using your own Bitcoin Wallet, but this marking reduces the fungibility of bitcoins and could potentially strand your asset if this happened to you. This risk could potentially be solved via Bitcoin Mixers and coin mixing protocols such as CoinJoin, but again this is a risk that will likely evolve over time as Bitcoin grows.

To help mitigate these real risks we recommend:

- Always taking full control of your Private Keys and never trust third parties

- Never share your private key or seed phrase with anyone, ever

- Start small with an amount of money you’re fully willing to lose

- Like with everything online, assume everyone (including us!) is a scammer

- Learn as much as you can about Bitcoin from us and others. The more you understand Bitcoin, the more confidence you’ll have and the higher a level you’ll achieve

- Don’t get greedy. Don’t buy altcoins. Don’t try and time the market

The Athena Assessment

Look. This isn’t financial advice. As stated all over the place “The information on this website is for general information purposes only. It is not intended as financial or investment advice and should not be construed or relied on as such.”

We’re not saying “stack sats” in the sense of financial advice. Instead we’re saying it because by stacking sats (any amount, even 100 sats) it will force you to actually use the Bitcoin network and gain experience and valuable insight into it.

Like all new things, you should be reading 20% of the time and doing the other 80%. If you’ve read most of our pieces up to this point you likely already know more about Bitcoin than 99% of most people (sad we know). The best way to learn is to do, so stack some sats!

The point is you’re not late. It’s not that hard and bitcoin is stupidly cheap. For $1 you can buy about 1,500 sats. Crazy. We’re certainly bullish on Bitcoin but as they say: Don’t Trust, Verify. Learn more about it (from us or others), use it, then learn more and use it more. The sooner you start the easier it will be. The best time to start anything is yesterday, the second best time is now, so get stacking!