Bitcoin isn’t real, it’s just a scam. It’s a bubble! It’s so volatile and gets hacked all the time it’s ridiculous! All points you’ve likely heard repeated by the main stream media causing confusion and doubt.

They’re all full of shit.

These “experts” get Bitcoin incredibly wrong. Constantly and incredibly wrong all the time! It’s embarrassing how wrong they get it. You’ll have supposedly “respected” multi million dollar companies and even Central Banks spouting objectively false information that’s easily debunked in one or two sentences of logic. It’s embarrassing.

So today we’re debunking the top 10 Bitcoin myths that we see All. The. Time.

Contents

Why Bitcoin Myths Exist

When searching for basic information about Bitcoin most people just go to Google and type in something like “What is a Bitcoin?“. This usually gets your results from two sources:

- Major News Providers: These overwhelmingly write sensationalist news pieces – as that’s what gets clicks – and are written by people that don’t properly Understand Bitcoin giving you poor and extremely incorrect information

- Big Private Companies: These are entities like centralized exchanges (eg. Coinbase, Kraken etc). They understand the technology, but the pieces they write are often thinly veiled ads to try and convince you to start day trading other cryptocurrencies on their platforms so they can make money off you

All this results in myths getting repeated over and over, so we thought it important to address each of them clearly and concisely as the confusion surrounding them still prevents many users from adopting Bitcoin.

Bitcoin Has No Intrinsic Value

Other Forms Of This Myth:

- Bitcoin Is A Scam

- It’s not backed by anything!

- No government guarantees it

- Bitcoin is purely digital & backed by nothing

Unlike fiat currencies or physical commodities such as gold or oil, Bitcoin isn’t guaranteed by any government or have some other use case for it (intrinsic value) which leads many to ask, well why do they have any value at all then?

This type of reasoning misses something quite obvious though, which is that bitcoins are valuable because they’re amazing at being money.

It’s kind of silly that this is even something that has to be pointed out really. Bitcoin was designed and built to be the best money for all of humanity. The apex predator of all money. That is its use case. That is its purpose and why it’s valued. It’s amazing money. The fact that you can’t also use bitcoins to make pretty jewellery or power jet engines doesn’t matter.

| Fiat | Bitcoin | Gold | |

|---|---|---|---|

| Scarcity | Low | High | Medium |

| Durability | Medium | High | High |

| Acceptability | High | Medium | Low |

| Portability | Medium | High | Low |

| Divisibility | Medium | High | Low |

| Fungibility | High | High | High |

As covered in What Is A Bitcoin Worth, people value and use Bitcoin voluntarily because its monetary properties (shown above) are better than any other money in the world.

The Government Will Shut Bitcoin Down

Other Forms Of This Myth:

- Didn’t China ban Bitcoin?

- Can’t the government just ban it?

- The government will never let a non-state money take over

In order to completely shut down the Bitcoin network a government would need to reach out across the entire world, into tens of thousands of private citizens houses in over two hundred different countries they don’t control and physically switch off and destroy every Bitcoin Full Node. If even just one survived, so too would Bitcoin. For all intents and purposes, Bitcoin is impossible to kill.

The game theory of Bitcoin also means that if one government “bans” it, other countries will simply embrace the technology and become rich off the businesses, miners, investors and so on that now all flow there instead.

We actually got to see this dynamic play out in real life back in 2021 when China, the second most powerful country in the world, “banned” Bitcoin Mining. In July 2021, the mining capacity of China plummeted to zero as all the legitimate mining businesses abandoned the country, taking their business (and money) mainly to the USA. By September 2021 it was back at 22%.

Despite being banned, the Chinese crypto market recorded an estimated $86.4 billion in raw transaction volume between July 2022 and June 2023, dwarfing Hong Kong, which witnessed $64 billion in crypto trading, Chainalysis said.

Chainalysis via Reuters

China lost billions in investment and taxes and now still has a sizeable – but now black market – mining and trading network. This inability to ban Bitcoin has also played out in other smaller countries like Nigeria too, where their central bank “banned” it only to later on rescind that ban as it was so ineffective.

This myth also misses a very important point that many high profile government officials already own sizable amounts of bitcoin in their portfolios. From Ted Cruz in Texas all the way up to literal presidents in El Salvador, there are hundreds in power that stack sats. As a result, it’s highly unlikely any government will try to ban Bitcoin, but even if they did, it’s clear it doesn’t work.

Bitcoin is Too Volatile

Other Forms Of This Myth:

- Bitcoin is too volatile and so can’t be a useful currency or store-of-value

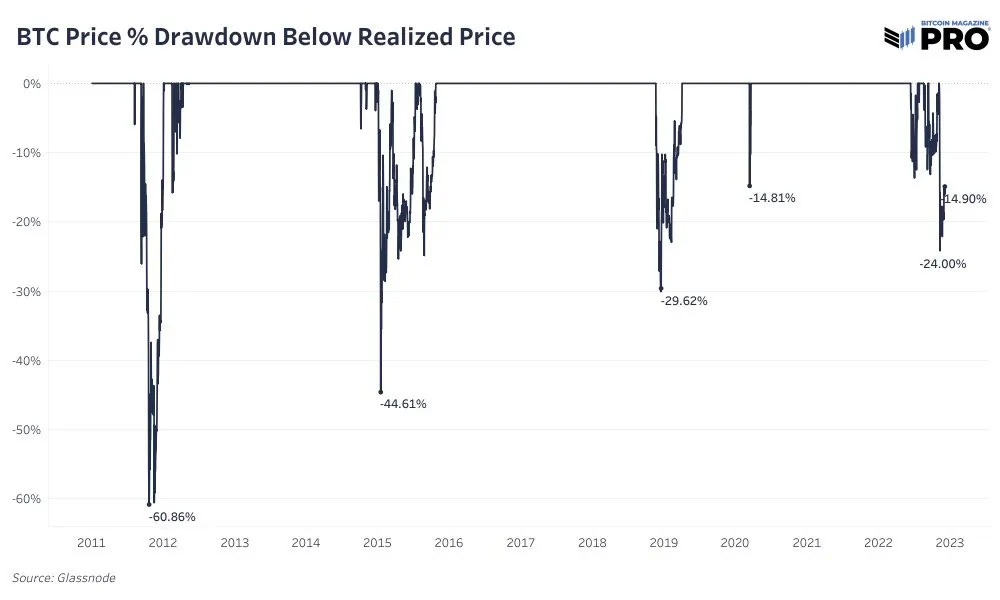

Bitcoin has been extremely volatile over the past decade, mainly due to the small size of its Market Cap but also other reasons. As an assets market cap gets bigger, its volatility typically decreases due to its liquidity increasing.

For example, if someone buys $100 billion worth of Bitcoin that’s 8% or so of the market and would hugely move the price up/down. If they bought $100 billion worth of Shares though, it’d only be about 0.2% of that market, causing a much smaller spike in volatility. Bitcoins volatility has already reduced greatly since it first debuted as seen in the data below.

Bitcoins volatility isn’t an inherit flaw in its systems, it’s just something that happens to any smaller asset class as it’s growing up. As it grows bigger and bigger, its volatility will reduce further until it’s on par with other established assets like gold or stocks.

>> Dive Deeper: Why Is Bitcoin So Volatile & Will It Ever Be Stable?

Bitcoin Wastes Energy

Other Forms Of This Myth:

- It’s bad for the environment

- Bitcoin’s mining process uses heaps of energy and is therefore wasteful

Bitcoin Mining and its Proof of Work consensus mechanism absolutely uses energy. But. To claim that it “wastes” energy implies that it has no use that’s valuable to anyone.

Energy use is also separate from carbon emissions and although it uses a lot of energy, Bitcoin mining is actually one of the cleanest and greenest industries in the world.

When various sources refer to Bitcoin’s energy usage as “wasteful” what they’re really saying is “this energy use isn’t useful to me, so it should be stopped”. These people need to check their financial privilege!

These people sit pretty in their first world countries with fully developed and (mostly) stable financial systems. They have a bank account. Can get a loan anytime they want. Can earn $100 and have it still be worth pretty close to $100 the next year. However this is the exception, not the rule for the world.

87% of our planet’s population are born into autocracy or untrustworthy currencies. 4.3 billion people live under authoritarianism, and 1.2 billion people live under double- or triple-digit inflation

Alex Gladstein

For over 4 billion people in our world Bitcoin is a shining beacon of hope. For billions it gives them their first actual bank account ever. Just imagine if you had no bank account at all. Think how that would limit your life. Think of all the things you wouldn’t be able to do.

In Egypt, for example, a country of 100 million people, 74% of people don’t have a bank account. In Nigeria it’s 55%, in Indonesia it’s 50%, and in India it’s 23%.

Bitcoin’s energy consumption isn’t “a waste”, it provides a core, vital service for literally billions of people all around the planet that have never had free, open source money that they can use without it being debased or banned or stolen by their government.

It stops peoples life savings being inflated away in Nigeria. It allows remittance for free and in seconds for millions in El Salvador, Africa and all the world. It helps refugees of Ukraine flee their war torn country without being robbed of all their money on the way.

Furthermore, if you’re an advocate for Bitcoin such as we are, we’d like to encourage you to partner with and support Climate Change Activists rather than fight against them. They’re often fighting for very similar goals as we outline in detail in our piece Bitcoiners Should Love Climate Change Activists.

Bitcoin is Used By Criminals

Other Forms Of This Myth:

- It enables criminal activity

- It’s only used for money laundering

In its earlier days Bitcoin was used in the now defunct Silk Road website that traded drugs among other things leading many to believe that this was all it’s used for. However multiple reports all point to bitcoins criminal usage being well below the estimated criminal usage of legacy financial systems.

The UN estimates that 2%-5% of global (fiat) GDP is connected with money laundering and illicit activity. By contrast a Chainalysis’ 2021 report estimates criminal use of all cryptocurrency transactions to be 2.1%.

Cases of laundering through cryptocurrencies remain relatively small compared to the volumes of cash laundered through traditional methods

SWIFT

It’s extremely clear to anyone who looks that criminals overwhelmingly prefer to use traditional financial institutions when it comes to breaking the law. After all, why would you want to record your illegal actions on a publicly visible, immutable ledger for all the world to see?

Finally, all these reports generally lump Bitcoin in with all other “cryptocurrencies”. We’ve covered before in detail how it should be Bitcoin not Crypto.

Many cryptocurrencies are built entirely for fraud and scam purposes which means the actual criminal activity of just Bitcoin in these reports is likely far less than even the small percentages reported.

New to Athena Alpha? Start today!

Bitcoin Can Be Cloned

Other Forms Of This Myth:

- Bitcoin’s old technology

- What about [altcoin du jour]?

- Bitcoin will be replaced by the competition

- Anyone can just copy Bitcoin so it’s nothing special

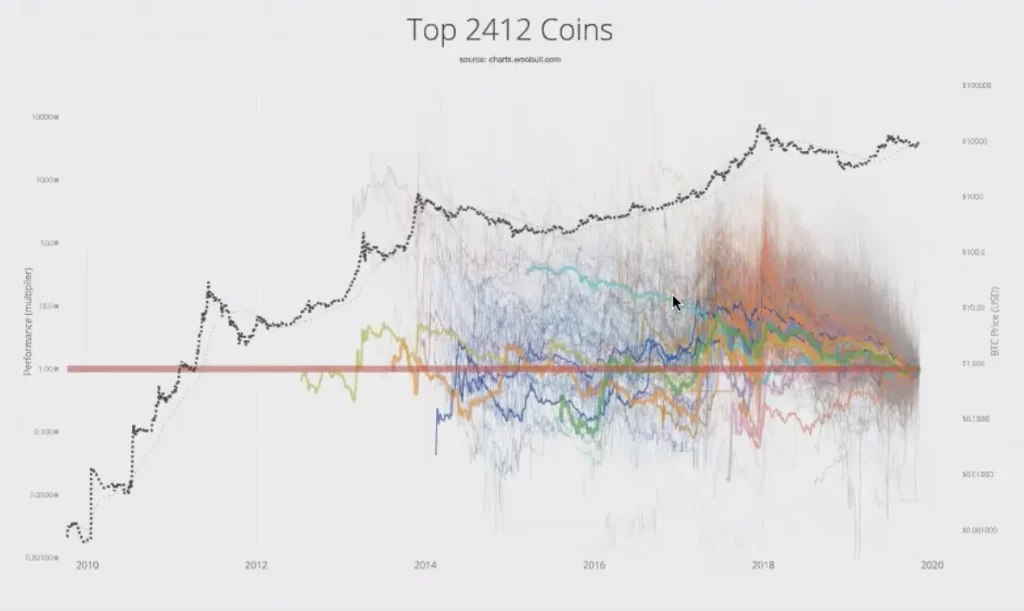

As an open-source software protocol, it has always been possible to copy Bitcoin’s code and there’s been no shortage of people trying to build “Bitcoin 2.0”. There’s been thousands of competitors that have cropped up over the years all trying to add new features and make it better (usually to benefit themselves over others).

These altcoins are not Bitcoin and will never be able to catch up as even though you can copy Bitcoin’s code, you can never copy its Network Effect, which is the most important advantage it has by far.

This network effect encompasses things like it’s brand awareness, the global liquidity of its market, the hordes of devoted developers that maintain and improve the code through countless Bitcoin Improvement Proposals and more.

By many objective metrics Bitcoin is orders of magnitude bigger than any of its competitors. Money is also a winner takes all environment and just like no one uses Bing (apologies to the 12 of you out there) no one else is using anything but Bitcoin for a store of value or stateless money.

Its unique creation, community, size, brand name and liquidity are all unmatched and will only further increase due to these advantages.

Bitcoin also isn’t a static protocol. There have been many changes and major upgrades to it over the years thanks to those dedicated developers. It will continue to be upgraded and add newer and better features just like all software does.

As such, believing that you can just “copy” Bitcoin is as dumb as suggesting anyone can just “copy” the internet.

Bitcoin Is A Bubble

Other Forms Of This Myth:

- Bitcoin doesn’t do anything, it’s just a bubble

- Bitcoin is just like tulip-bulbs, it’s a bubble that will collapse

During the Store Of Value stage of a money, the new money will “monetize” and go through multiple periods where supply and demand don’t align properly which causes high volatility. This in many cases can indeed create a bubble just like in any other market leading to endless headlines that “Bitcoin is dead!” when it bursts.

This doesn’t change Bitcoins underlying utility though and every time it’s burst it has lived on with its network size, number of users and use cases soaring even faster than the Internet. It will no doubt still form bubbles as we go through more supply/demand crunches, but over the years Bitcoin has also always come out bigger and better.

If Bitcoin truly was a bubble, then it would crash and never return. The fact that it’s only getting bigger and better means it’s not.

Bitcoin Fails As a Currency

Other Forms Of This Myth:

- No one accepts it so it can’t be used as a currency

- Bitcoin is too volatile to be a day-to-day currency

As it stands today, Bitcoin isn’t what most people use for their day to day purchases. That being said you can absolutely pay your bills (or anything else) with it in many countries using Bitcoin Debit Cards, use it natively at hundreds of thousands of locations as outlined in What Can You Do With Bitcoin and also use it without being exposed to its volatile price via apps like Strike.

There’s also many other use cases for money beyond simply buying your daily coffee with it. Currently Bitcoins main usage is as a Store Of Value which it does exceptionally well. Over the next 10 years it’s expected to monetize further into into a Medium Of Exchange which is what most people view as “money” these days.

Even if it never progresses to this next stage though, simply being a better store of value than gold could potentially have it take significant market share away from golds current $10 trillion market cap.

Bitcoin Can’t Scale

Other Forms Of This Myth:

- Bitcoin transactions are too slow

- Its transaction fees are too high to buy things

- Bitcoin only supports 7 transactions per second, so it will never be a global currency.

At Bitcoins base layer, transactions take around 10 minutes to 1 hour to fully settle and support a theoretical throughput of around 7-10 transaction per second. This is quite a bit less than the thousands or tens of thousands of transactions per second that Visa or Master Card can manage, but this is comparing apples to oranges as a Bitcoin transaction is very different to a Visa one.

Visa transactions don’t get fully settled until days or weeks later. When you compare Bitcoin to the base layers of what other money runs on such as Fedwire it’s actually the fastest by far.

Taking 10 minutes to settle literally any value (even billions of dollars) with any other party anywhere in the world and at any time, day or night is light years ahead of the days to weeks (and sometimes months!) other systems take.

If you do wish to use bitcoins to purchase thousands of cups of coffee every second though then you can use the ever growing Lightning Network. This allows for instant and near free transactions on top of Bitcoins base layer and is much more comparable to what the Visa network is.

Learn More: What Is The Lightning Network?

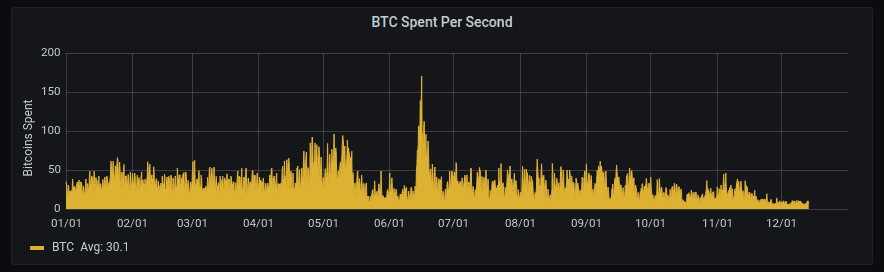

Regarding it’s scale, the Bitcoin network has settled almost 1 billion bitcoins or over $60 trillion dollars for the year of 2022. This is up from last year when it settled around $45 trillion dollars which is ~4 times the volume of Visa.

Bitcoin Isn’t Safe / Gets Hacked

Other Forms Of This Myth:

- Bitcoin keeps getting hacked and so isn’t safe

This is a common misconception often rooted in the misunderstanding about Bitcoin the network and the cyber security (or lack there of) of the companies and people that use Bitcoin. News stories that report Bitcoin getting “hacked” always refer to centralized services or companies that simply use Bitcoin and have suffered a cyber attack.

Bitcoin the network and protocol is run by hundreds of thousands of nodes around the world and is quite possibly the most secure network ever built. It has never been hacked and continues to be secured by all Bitcoin Mining that protects the network from a variety of attacks.

Deep Dive: Is Bitcoin Safe? What Savvy Investors Need To Know

FAQ

How Do I Store Bitcoin?

Storing bitcoins is done by downloading and installing a Bitcoin Wallet. Beyond this you can purchase a Hardware Wallet (also called a signing device) to enable a much higher level of protection for your bitcoins.

Bitcoin Is Too Expensive / It’s Only For The Rich / I Can’t Afford Bitcoin

How Can Bitcoin Function As A Worldwide Currency With Only 21 Million Coins?

While there will only ever be just slightly less than 21 million bitcoins, each bitcoin can be divided up into 100,000,000 pieces called Satoshi. As such, the Bitcoin network actually allows for up to 2,100,000,000,000,000 Satoshi units.

If we were to cut these units up like we do with normal dollars (100 cents to $1) then we could have 21 trillion “dollars” which should easily be enough for a global currency.

Additionally, the limited supply of bitcoins isn’t a barrier to it being used as a global money. Gold was used this way for thousands of years and even today, there is only around 200,000 tons of it. All the gold in the world fits in a cube that’s 22 meters on each side!

Bitcoin Is Too Complex To Be Money

If you want to properly understand at a fundamental level then yes, it can be complicated. But. So is email or a plane or your microwave and you can easily use them without this fundamental understanding.