Navigating the complexities of finance can feel like decoding an ancient manuscript with one of the most common words used in it being volatility. So why is Bitcoin so volatile? Is it because there’s something fundamentally wrong with it? Does it have a flaw that other cryptocurrencies or stocks don’t have?

No. In fact, it’s mostly got nothing to do with Bitcoin per say, it’s simply due to the fact that it’s a very new asset class that has relatively low liquidity compared to other massive and more mature markets like stocks or bonds.

Contents

What Is Price Volatility?

Price volatility in the financial markets refers to how much of an increase or decrease an asset has over time. For example, if one asset goes up 100% then down 200% it would be considered more volatile than another asset that only went up 10% and then down 20%.

While volatility measurements can be applied to many things, for this piece we’re mainly interested in the price volatility, or how much an assets market price goes up or down. Higher volatility also usually results in that particular asset being more riskier for the investor. While this means they can get better returns, it also means they can suffer worse losses too.

Crypto Volatility Vs Regular Market Volatility

In traditional financial markets such as the stock market, its common for the trading of shares to be “halted” sometimes when there’s extreme volatility detected due to too many investors buying or selling that particular share.

The share is temporarily halted and it’s no longer possible for investors to buy or sell those specific shares for the rest of the day. As cryptocurrency markets operate world wide and in thousands of different exchanges – some fully decentralized like Bisq – it’s impossible to halt trading.

This means that if digital currencies are going up or down, it’s entirely up to the free market to stop it. There’s no central authority to stop a huge crashing market or put the breaks on digital assets going to the Moon, even if this increase in price makes zero logical sense.

| Year | Start | End | Return |

|---|---|---|---|

| 2009 | $0 | $0 | 0% |

| 2010 | $0.0025 | $0.10 | 3,900% |

| 2011 | $1 | $30 | 2,900% |

| 2012 | $5.31 | $14 | 164% |

| 2013 | $20 | $755 | 3,675% |

| 2014 | $767 | $317 | -59% |

| 2015 | $314 | $431 | 37% |

| 2016 | $434 | $960 | 121% |

| 2017 | $998 | $14,839 | 1,387% |

| 2018 | $14,093 | $3,809 | -73% |

| 2019 | $3,692 | $7,240 | 96% |

| 2020 | $7,244 | $28,837 | 298% |

| 2021 | $28,665 | $48,022 | 67% |

| 2022 | $48,082 | $16,540 | -66% |

| 2023 | $16,541 | $42,208 | 155% |

| 2024 | $42,208 | $93,508 | 122% |

| 2025 | $93,508 |

While there are some valid arguments to be had regarding traditional markets and these types of “safe guards”, it inherently means that it’s not longer a truly free market. Someone has the ability to stop or start the market at whatever times they see fit, which of course could be manipulated to their own advantage.

Crypto and mainstream markets operate on very similar rules, but with many unique differences like described above. This means that if you as an investor want to buy bitcoin or other coins, you need to be aware of these differences and how they’ll affect your investment.

Why Is Bitcoin So Volatile?

New to Athena Alpha? Start today!

There’s a number of reasons why Bitcoin specifically is one of the most volatile assets out there. We’ll go through a number of these reasons below, but in general it’s simply due to it still being a very new asset class that has relatively low liquidity compared to other mature markets like stocks or bonds.

Low Liquidity

To begin with we need to understand and look at liquidity. Liquidity is how much someone can buy or exchange an asset without drastically moving its price in the process. Bitcoin’s volatility has been extreme over the past decade mainly due to its low liquidity in markets around the world.

Is Market Cap is tiny compared to other more mature assets like bonds or gold which means its price will fluctuate more if and when large investors enter the market.

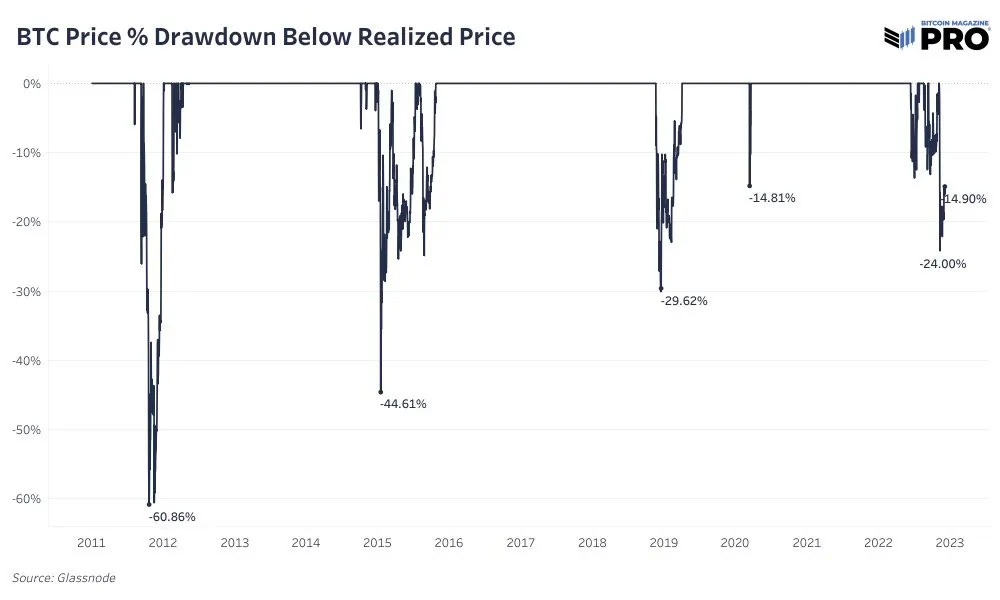

For example, if someone buys $100 billion worth of Bitcoin that’s 12% or so of the market and would hugely move the price up/down. If they bought $100 billion worth of Shares though, it’d only be about 0.3% of that market, causing a much smaller spike in volatility. Bitcoins volatility has already reduced greatly since it first debuted as seen in the data below.

An important factor behind why Bitcoin has been getting less and less volatile is precisely because of this increased liquidity. It’s positive feedback loop as the more stable Bitcoin is, the more people are willing to invest in it and the more liquidity increases making it even more stable.

Supply, Demand & The Halving

Another core reason for Bitcoin’s volatility is its unique supply and demand setup. It’s economics 101 that the price of something is directly related to its supply and demand. If supply stays the same or decreases at the same time as demand increases you get higher prices.

These higher prices encourage producers to make more of the item which increases supply and returns things to an equilibrium. This imbalance happens it two different ways with Bitcoin.

Adoption Waves

As a money “monetizes” or moves through the various stages of becoming a money, its value as compared to other monies increases. Specifically, in the second stage “Store Of Value” which is where Bitcoin is now, the price increases in bursts as adoption of the money happens in cascading waves over time.

These waves of new people usually get on boarded during crypto bull markets and can result in the price being highly volatile during that time. Maybe there’s a huge influx of new people wanting to buy bitcoins, but due to low liquidity there’s not enough to go around. Supply drops, demand increases and you get a bubble that eventually bursts.

This is the first way that Bitcoins supply and demand can get out of balance and cause very sharp spikes either up or down which is what drives a lot of its volatility.

Bitcoin Halvings

The second way the supply/demand balance is completely thrown out the window is due to the Bitcoin Halving.

The Bitcoin Halving (also called Bitcoin Halvening) is when the block subsidy that’s rewarded to Bitcoin miners is halved. Currently in 2023 the block subsidy is 6.25 BTC, but next year it will reduce to 3.125 BTC once the Bitcoin Blockchain hits a block height of 840,000.

As the only place new Bitcoins are minted is by Bitcoin Mining, this Halving event cuts the entire supply of all new Bitcoins world wide in half. The general demand for Bitcoin still remains the same though, so you have a huge imbalance that usually takes a good 6-18 months to work itself out as the price of Bitcoin goes into a price discovery phase trying to determine what the new normal will be.

Dive Deeper: What Is Bitcoin Mining?

Speculation And Hype

As time goes by and these supply and demand imbalances occur again and again it often spurs huge speculation and hype trains which makes the volatility even worse.

This high volatility then attracts day traders that are looking to make a quick buck which further distorts the price and volatility of Bitcoin. You get price swings with financial markets going crazy due to all the hype and the high volatility turns into extreme volatility.

One of the most well know “features” of Bitcoin is its Number go Up (NgU) technology. A fun shorthand people use to refer to this regular 4 year halving cycle. The halving happens, which cuts supply in half causing the price to slowly increase to bring the market back in balance again. As the price increases, Bitcoin attracts more and more attention eventually exploding into a full blown clown market.

It’s in these extreme economic circumstances where the price is going up and down at an extreme pace that investors need to be most careful. Low volatility combined with the huge hype means the short term volatility explodes and investor sentiment can go from euphoric to tragic and back again in hours.

Crypto Market Volatility

At the end of the day, Bitcoins volatility isn’t an inherit flaw in its systems, it’s just something that happens to any smaller asset class as it’s growing up. As it grows bigger and bigger, its liquidity will increase as more and more crypto investors enter the market, which will in turn reduce its volatility until it’s on par with other established assets like gold or stocks.

This reduction in volatility will make it less profitable for day traders and speculators which means they’ll be less likely to get involved, further reducing the volatility even more. What may not stop though are the price movements due to each Halving.

Even if Bitcoin had a $100 Trillion market cap, about 100x what it is now, a cut in half of the supply is still going to send massive shock waves across the crypto markets. Qualified professional financial advisors need to be aware of these types of factors in order to better understand Bitcoin as an asset class so they can advise their clients better.

Will Bitcoin Ever Be Less Volatile?

According to recent studies:

The most important factors for Bitcoin volatility are Google trends, total circulation of Bitcoins, US consumer confidence and the S&P500 index

2022 Study

This seems to indicate that the Bitcoin price is still heavily influenced by the financial decisions of both small and large holders. These growing pains are expected as said for such cases where an asset is new and monetizing.

Bitcoin’s already been getting more and more stable, but these things simply take time. It’s reasonable to expect that as Bitcoins market cap increases to match other large assets such as Gold at around $10T, it should have similar, but not the same, volatility as it does.

As said, even if it had exactly the same market cap, gold doesn’t have the Halving every four years and is also not a new, exciting technology. When it comes right down to it, the main factors for investors to remember is that with more volatility comes more risk, and this risk can cut both way, so be weary!

FAQ

Why Is Bitcoin More Volatile Than Gold?

Bitcoin is still an infant asset class, especially compared to gold which is thousands of years old. With this maturity comes larger liquidity, a much more evolved regulatory environment and more experienced institutional investors. Meanwhile Bitcoin is still heavily dominated by the less experienced retail market and has low liquidity with a much more disruptive supply and demand setup.

How Do You Reduce Bitcoin Volatility?

While individual investors have no control over the underlying volatility of Bitcoin, there are various ways that you can help ensure your investments have less volatility. These include having a longer term perspective (ie. hodling), having a properly diversified portfolio, being aware of the risk and ensure you stay informed and don’t allow your emotions to dictate your trading decisions.

Are Stocks More Volatile Than Crypto?

In general, no. While there’s certainly been specific windows of time where the volatility of stocks was larger than Bitcoin, this isn’t the norm. Due to the various controls that traditional markets have in place together with stocks being a more mature market in general with much more liquidity, their volatility is less than Bitcoins.

Is Crypto Volatility Bad?

The overall crypto market has exceptionally high volatility. This is due to a number of reasons such as little to no regulation, exceptionally small liquidity, the Halving and especially hype and speculation. While many paint volatility as a purely “bad” thing, it can also be an opportunity to earn a lot of money. This isn’t something we recommend doing though, as the vast majority of people get rekt, but it is technically possible.

How Volatile Is The Bitcoin Market?

Bitcoin’s market has always had high volatility right from the start over a decade ago. There have been daily price swings ranging from a few percent to double digits. This puts it in another league altogether when compared to the relative stability of traditional financial markets. Altcoins and the random popular cryptocurrency du jour are even worse with the vast, vast majority of them trending to zero over just a few years.